Executive Summary

In order to enhance the development of Singapore’s equities market, the Monetary Authority of Singapore (“MAS“) established the Equities Market Review Group (“Review Group“) on 2 August 2024 to recommend suitable measures in this regard. On 21 February 2025, the Review Group made its first set of recommendations which includes the following:

- Consolidate the listing suitability review and the prospectus review for Mainboard listing applications under Singapore Exchange Regulation (“SGX RegCo“). Currently, the listing suitability review is carried out by SGX RegCo and the prospectus review is carried out by MAS. The new approach will apply to corporations, business trusts and real estate investment trusts (“REITs“) (collectively, “issuers“) in respect of offers of securities, securities-based derivatives contracts, and units in a REIT issued by them, in conjunction with a listing on the Mainboard of the SGX-ST under Chapter 2 of the SGX-ST Listing Rules (Mainboard) (“Mainboard Rules“); and

- Listing applications need not be subject to the Listings Advisory Committee (“LAC“) process.

The aim of these recommendations is to provide prospective issuers with greater clarity on the listing process and reduce uncertainty of the process and time to markets, as prospective issuers will only have to engage with SGX RegCo going forward. MAS has issued a Consultation Paper on Proposals to Consolidate Listing Suitability and Prospectus Review Functions to seek comments on the proposed consolidation of the listing review functions for Mainboard listing applications be consolidated under SGX RegCo (“MAS Consultation Paper“). To operationalise the proposed consolidation, SGX RegCo seeks feedback on changes to the relevant Mainboard Rules in its Consultation Paper on Consolidation of Listing Review Functions under SGX RegCo (“SGX Consultation Paper“). SGX RegCo also seeks comments on standing down the LAC. Both consultations will end on 29 November 2025. This Update provides a summary of the key proposals under both Consultation Papers.

MAS Consultation: Consolidating Listing Review Functions under SGX RegCo

Scope of MAS Powers, Functions and Duties Delegated to SGX RegCo

As highlighted in the Executive Summary, the current listing process involves both MAS and SGX RegCo. This process, together with the need to subject Mainboard listing applications to the LAC process (which is discussed more later), prolongs time to market and increases uncertainty for potential issuers.

MAS proposes to delegate its powers, functions, and duties related to prospectus lodgment and registration under Part 13 of the Securities and Futures Act 2001 (“SFA“) to SGX RegCo, appointing SGX RegCo as its assistant under section 320(1) of the SFA (“Proposed Delegation“).

MAS will continue to be the statutory regulator, exercising oversight over SGX RegCo, including with respect to SGX RegCo’s exercise of MAS’ powers and performance of MAS’ functions and duties under the Proposed Delegation. MAS will also continue to investigate and take actions for breaches under Part 13 of the SFA, determine regulatory requirements in relation to prospectus disclosures, and approve any applications for exemption from these requirements.

For more details regarding the powers, functions and duties in the SFA and relevant subsidiary legislation to be delegated to SGX RegCo for Mainboard Listings, please refer to Annex 1 to the MAS Consultation Paper.

New Consolidated Listing Review Process

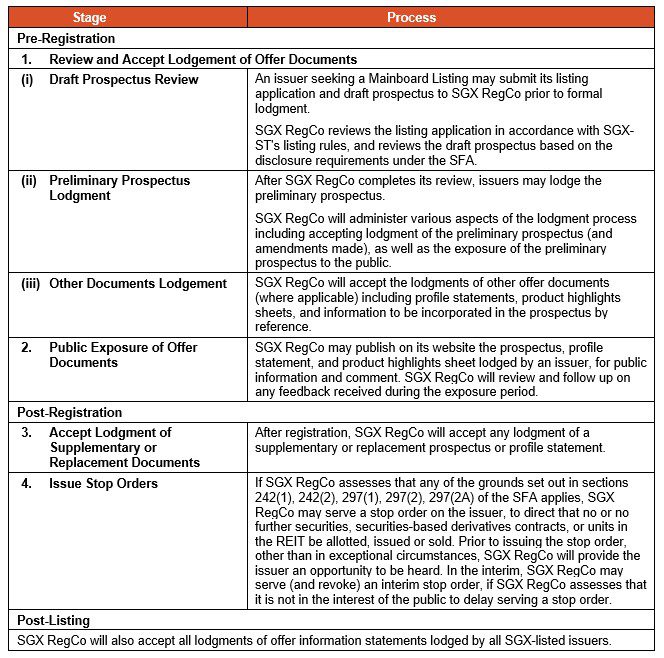

Under the Proposed Delegation, instead of submitting its prospectus to MAS, an issuer will submit its prospectus to SGX RegCo. SGX RegCo will then review, accept lodgment of, and register the prospectus for the purposes of Part 13 of the SFA on MAS’ behalf, according to the new process as follows:

SGX Consultation: Amendments to Mainboard Rules to Consolidate Listing Review Functions and Removal of LAC Process

If the Proposed Delegation is implemented, SGX RegCo will:

- Make amendments to the Mainboard Rules, namely the Definitions and Interpretation section, Chapters 2, 3, 4, 6, and 8, as well as Appendix 8.2. Practice Notes 2.1 and 6.1 will be made to reflect the Proposed Delegation; and

- Introduce a new Practice Note to the Mainboard Rules to set out the administrative procedures that will apply, such as the documents to be submitted to SGX RegCo and the timelines that will apply. SGX RegCo will notify market participants of the New Practice Note in due course.

For details of the amendments to the Mainboard Rules, please refer to the Appendix to the SGX Consultation Paper.

Removal of the LAC Process

To streamline the listing timeline and reduce uncertainty for prospective issuers, the Review Group also recommended removing the LAC process from Mainboard listing applications. By way of background, the LAC was introduced in 2015, to address concerns about SGX’s independence and effectiveness as a frontline regulator, along with introducing practitioner experience to the listing decision making process. In order to address potential conflicts between SGX’s commercial objectives and regulatory responsibilities, all of SGX’s frontline regulatory functions were transferred to SGX RegCo in 2017.

To implement this change, Mainboard Rule 110 will be deleted and Rule 1428 amended accordingly.

If you have any queries on the above, please reach out to our Contacts or KM at [email protected].

Disclaimer

Rajah & Tann Asia is a network of member firms with local legal practices in Cambodia, Indonesia, Lao PDR, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam. Our Asian network also includes our regional office in China as well as regional desks focused on Brunei, Japan and South Asia. Member firms are independently constituted and regulated in accordance with relevant local requirements.

The contents of this publication are owned by Rajah & Tann Asia together with each of its member firms and are subject to all relevant protection (including but not limited to copyright protection) under the laws of each of the countries where the member firm operates and, through international treaties, other countries. No part of this publication may be reproduced, licensed, sold, published, transmitted, modified, adapted, publicly displayed, broadcast (including storage in any medium by electronic means whether or not transiently for any purpose save as permitted herein) without the prior written permission of Rajah & Tann Asia or its respective member firms.

Please note also that whilst the information in this publication is correct to the best of our knowledge and belief at the time of writing, it is only intended to provide a general guide to the subject matter and should not be treated as legal advice or a substitute for specific professional advice for any particular course of action as such information may not suit your specific business and operational requirements. You should seek legal advice for your specific situation. In addition, the information in this publication does not create any relationship, whether legally binding or otherwise. Rajah & Tann Asia and its member firms do not accept, and fully disclaim, responsibility for any loss or damage which may result from accessing or relying on the information in this publication.